Nandini Roy Choudhury, writer

Brief news

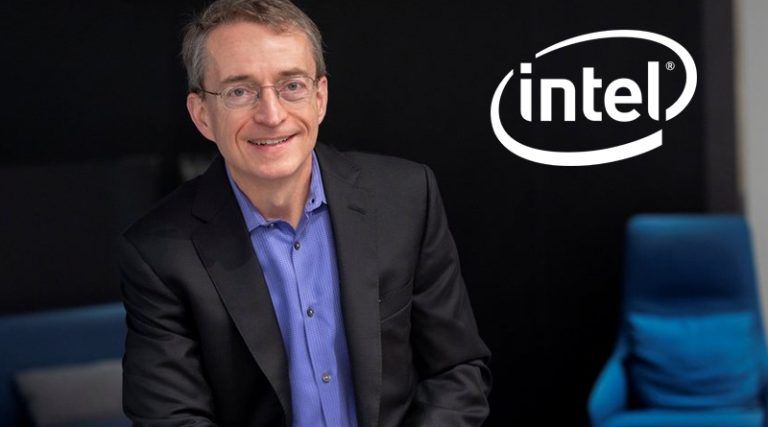

- Intel CEO Pat Gelsinger resigned effective December 1 after a challenging four-year term marked by declining stock prices and market share.

- David Zinsner and MJ Holthaus have been appointed as interim co-CEOs, while Frank Yeary becomes the interim executive chair.

- Intel’s stock has dropped 52% year-to-date, and the company faces skepticism over its future amid competition from Nvidia and struggles in the AI sector.

Detailed news

Intel announced on Monday that its Chief Executive Officer, Pat Gelsinger, has resigned from his position effective December 1. This marked the culmination of a turbulent nearly four-year leadership term at the company, which had been the most successful semiconductor company in the United States in the past but experienced a decline in both its stock price and market share during his tenure.

David Zinsner, the Chief Financial Officer of Intel, and MJ Holthaus, the Chief Executive Officer of Intel Products, have been appointed as interim co-CEOs. The interim executive chair of Intel will be Frank Yeary, who has been a member of the board for a long time. During the pre-market trading session on Monday, Intel shares increased by 5%.

Yeary, who has been a member of Intel’s board of directors for the longest amount of time, will now be involved in yet another search for a new CEO. Gelsinger had a distinguished career at Intel, where he rose through the ranks to become the company’s first chief technical officer at the turn of the century. After that, he relocated to EMC and assumed a prominent position there. Gelsinger came back to the firm in 2021, replacing Bob Swan, who was serving as CEO at the time, in order to stabilize Intel. He had previously been the CEO of VMware.

It has been a difficult year for all of us as we have made difficult but essential decisions to position Intel for the present market dynamics, as stated by Gelsinger in a press statement. “It has been a challenging year for all of us.”

Upon his arrival in 2021, Gelsinger devised a daring strategy to convert the struggling company into a chipmaking powerhouse. His goal was to make the company thrive. In order to compete with the two most prominent chipmakers, Samsung and Taiwan Semiconductor Manufacturing Company, he endeavored to attain parity from both of them. His pursuit of large-scale buildouts in the United States and around the world was an expensive enterprise that had a significant impact on Intel’s free cash flow and increased the amount of debt the business carried.

Given that the artificial intelligence wave boosted Intel’s competitor Nvidia and left Intel in the dust, investors became increasingly skeptical about the company’s future prospects. The market capitalization of the corporation is currently less than half of what it was in 2021, and it briefly broke the $100 billion threshold earlier this year.

The announcement of Gelsinger’s departure comes one week after Intel and the CHIPS and Science Act office completed the finalization of a $7.86 billion grant that is intended to fund the company’s ambitions to construct another factory.

The company Intel has been trapped in a prolonged downturn as a result of market share losses in its core businesses and an inability to break into the artificial intelligence industry. The company’s stock has plunged 52% year-to-date.

In September, Intel disclosed its intention to transform its foundry business into an independent subsidiary. This step would make it possible for the company to pursue financial opportunities from outside sources. When Intel announced in August that it would be laying off more than fifteen percent of its personnel as part of a cost-cutting strategy worth ten billion dollars, the company’s quarterly results were disappointing, which sparked the most significant stock market drop in fifty years. CNBC claimed that Intel has hired advisors in order to defend itself against investors who were acting in an activist capacity.

Late in the month of September, it was reported that Qualcomm had contacted Intel in an effort to discuss the possibility of a takeover.

Source : CNBC news